Newton's Laws

I’ve talked in this space several times about Supreme Court Justice Louis D. Brandeis (1856-1941), a strong advocate of tax-wise giving, and consequent legal interpretation over the years of the U.S. Tax Code and “Legitimate Tax Avoidance” and driving the extra mile to avoid the D.C. toll bridge to his chambers...

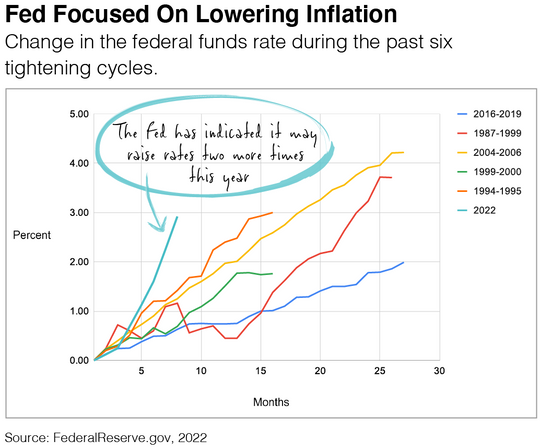

Traditionally, I’ve been a little cautious when people say, “it’s different this time.” After all, the past few years have seen more financial “firsts” than most. But despite that skepticism, this year saw five interest rate increases in seven months — making it the quickest tightening cycle in modern history.

The wealthy want to work with true experts who can help them make informed decisions to solve their most pressing financial concerns.

Many high net worth families are above their “freedom line.” They can choose to make more money, but it will not change their lives. These families are focused on the same issue – making the most from their money, in terms of personal enjoyment, philanthropy and leaving a legacy.

What is the goal of climbing Mt. Everest? Most people think it's to get to the top, but the primary goal is to get back down! Just like investing, we want to reach retirement, but we need to have a plan to make it all the way through retirement.

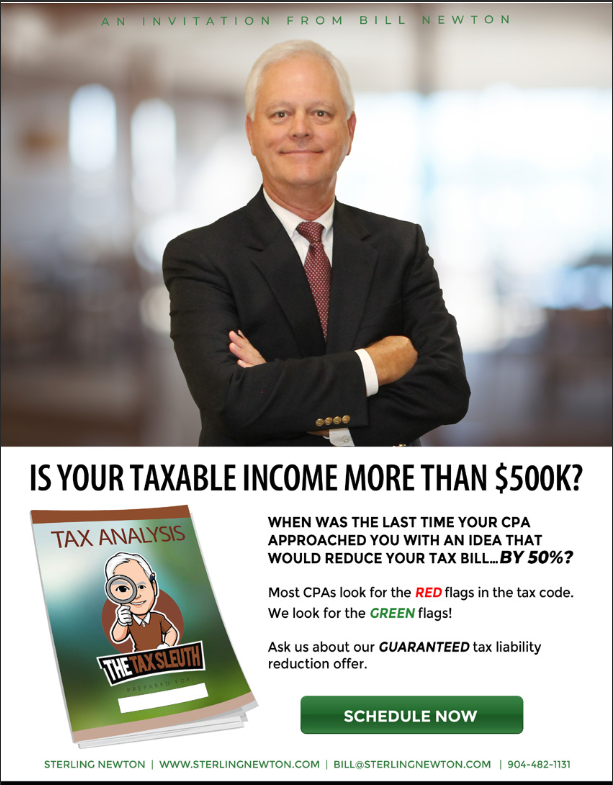

Tax compliance is not the same as tax planning. Your CPA or tax preparer may check all the right boxes to help keep you out of trouble, but that’s not enough! This is merely tax compliance. To save money, you need a tax planning strategy.

We are co-hosting our first webinar next Wednesday, June 9th at 2pm. Even if you've already filed your 2020 return, it's not too late to learn about and leverage specific tax strategies like Opportunity Zones and 1031 Exchanges.

Supreme Court Justice Louis D. Brandeis (1856-1941), a strong advocate of tax-wise giving, shared the following in his essay entitled Thoughts on Legitimate Tax Avoidance.

Inheriting money comes with plenty of benefits. But an inheritance—even a big one—doesn’t automatically mean a worry-free life of ease. A windfall can actually create unique challenges and conflicts that become the root of significant problems for your heirs—and for you, too.

Questions on your eligibility and penalties to take early distributions from retirement accounts under the CARES Act?